Contents:

If the report shows that the U.S. economy is creating more jobs than expected, it can cause the U.S. dollar to appreciate in value against other major currencies. This can cause currency pairs such as USD/JPY, USD/CHF, and USD/CAD to rise. If the report shows that the U.S. economy is creating more jobs than expected, it could lead to an increase in interest rates.

When using an OCO order, traders define criteria for two conditional orders. If the conditions for one order is met then it is executed, and the other order is cancelled – hence the name OCO – literally “One Cancels the Other”. We can also see that there was a round number resistance level at 1.040 that was a good level to key off, post the NFP report. However, in the minutes following the release, the price will start to move and ideally trend in one direction. It’s very important that we don’t trade around the actual release itself.

That is oftentimes simply just traders executing market orders and stops getting hit. There is no real follow-through and not much to be gained by being involved. Given the power of the NFP report in forex markets, it is important to firstly understand the best way to trade the release. For that reason, understanding how to trade the NFP in forex markets is both a vital skill for traders and one that can be very lucrative.

NON-FARM PAYROLL RELEASE DATES

The NFP data release is accompanied with increased volatility and widening spreads. With this being said you must take caution when trading on NFP days. One of the reasons why NFP data causes such a huge change in forex markets is because it’s what drives rates.

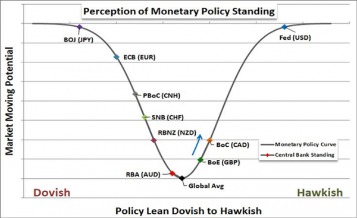

To combat this, and to avoid getting stopped-out, we recommend using the appropriate leverage, or no leverage at all. On the other side of the trade, more traders are pricing in the end of the Fed’s rate hike cycle. Like with the RBA, the markets will speculate on a “peak” rate for RBNZ. Some believe 5.00% should do it after a 450 bps increase since late 2021, but it will really depend on what data points the RBNZ will take a closer look at. Lirunex is offering a Non-Farm Payroll Machine contest for each NFP week.

This reading followed August’s increase of 315,000 and came in better than the market expectation of 250,000. Nonfarm Payrolls in the US rose by 223,000 in December, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading came in much higher than the market expectation of 200,000 and followed November’s increase of 256,000 .

Traders’ #1 Broker

A high reading is seen as a positive for the dollar, while a low reading is seen as negative . Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Forex Friday: NFP, GOLD, Guppy and Bitcoin – Action Forex

Forex Friday: NFP, GOLD, Guppy and Bitcoin.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

Historically, it has been observed that the correlation between the dollar index and NFP statistics has been slightly negative. Typically the Labor Statistics department will release the data every month on a Friday, the first of the month. Though the data is officially called the Employment Situation, it is more popularly called the jobs market.

We explain why understanding the implications of this release, reading the numbers, and trading NFP, in general, is so critical. Here are all of the NFP forex release dates in the year 2020, calendar taken from IG.com. More jobs also mean more money to go around, which lifts inflation and GDP.

Strategy Pitfalls

Pullbacks and price corrections to support levels are usually opportune entry points for long-term style trades. There is no denying that the non-farm payroll report triggers one of the largest and most consistent rate movements linked to any news update or announcement in the Forex market. And theEUR/USD is one of the most heavily and frequently traded currency pairs in the market, usually providing ample price movement and the smallest spread for making trades. Almost all economists agree the NFP (non-farm payroll) figure is a crucial economic indicator for the U.S. economy.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

We predict the EUR/USD will rise as a result of the worse-than-expected NFP report. Determine significant support and resistance levels with the help of pivot points. Learn how to trade forex in a fun and easy-to-understand format.

Easing employment conditions will fuel “peak rate” speculations for the Fed and likely weigh on USD against its riskier counterparts. Upside surprises, on the other hand, would give the Fed more room to return to rate hikes or at least delay rate cuts beyond early 2024. Keep close tabs on wage growth, which may have accelerated from 0.2% to 0.3% on a monthly basis and could fuel inflation concerns. IGCS shows retail traders are currently Long on Gold, with 57% of traders currently holding long positions.

US Open: Stocks rise cautiously ahead of a key week for risk events – FOREX.com

US Open: Stocks rise cautiously ahead of a key week for risk events.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

The elaboration of some macroeconomical analysis is essential for successful trading. This report is important because the US is the largest economy in the world and its currency is the global reserve currency. As a result, this approach is reserved and ideal for Forex swing traders as well as investors. And knowledge of various economic fundamentals is necessary to analyze the economic context and then make the right decision when investing. And in this case, it’s best to follow just bullish signals when these signals are present on the price chart.

Forex market how much a day?

what is nfp forex traders interested in small price changes or news traders whose news would affect the dollar could find trading during the NFP week profitable. For example, using the same stop loss for USD/CAD and GBP/USD is a common mistake. Instead, the major currency pairs mentioned above are the best to trade after the NFP report was released. Range trading is another strategy that traders use when trading the NFP report. Traders will typically place a buy order if the price is at the lower end of the range, and a sell order if the price is at the upper end of the range.

However, the unexpected happens when the market does not follow policy makers’ projections. Therefore, market expectations and unanticipated uncertainties are other factors that traders must consider. Forex traders utilize an economic calendar to anticipate the publication of the NFP. CAD/JPY volatility, March 2019, image courtesy of dailyfx.comThe US economy is particularly powerful and the forex markets are affected by a large number of factors. These are just some of the currency pairs that will be most volatile after theNDPfigures are released. This is why it’s so valuable to fully understandNFPin forex and how it all works, so that you, as a trader, can be on the right side of these massive market shifts during this time.

The Federal Reserve Bank views employment as a critical indicator. When unemployment is elevated, policymakers frequently pursue an expansionary monetary policy . An expansionary monetary policy seeks to boost economic production and employment.

And the figure represents the number of total jobs added, excluding government employees, farm employees, private household employees as well as employees of various nonprofit organizations. If it is higher than usual, it is anticipated that the economy is running slow, and policymakers will try to increase it. Such a stimulatory policy comes with low-interest rates and decreases the demand for the Dollar. You will learn about how it affects you and the right strategies to implement regarding the same.

Conversely, low readings indicate a negatively https://g-markets.net/ed economy. The reason is that more job creation leads to a healthier and more robust economy. In addition, with a job and money, consumers tend to spend more, which leads to economic growth. Non-farm Payrolls is one of Forex’s most influential market movers.